Top 6 Must-Have Features for a Successful Financial App

Having the correct tools at your disposal for your financial app can make all the difference in the fast-paced world of finance. A well-designed financial app may substantially ease your life, whether you're an individual handling your personal accounts or a business owner overseeing company spending. But, with so many alternatives available, how can you decide which features are critical for a successful app?

Look no further because we'll be exploring the top 6 must-have features that any financial app should have in this article. These features, which range from user-friendly interfaces to solid security measures, are intended to improve your financial management experience and help you achieve your goals with confidence.

So, if you're ready to take control of your finances and make the most of contemporary technology, let's begin with the must-have features for a successful app.

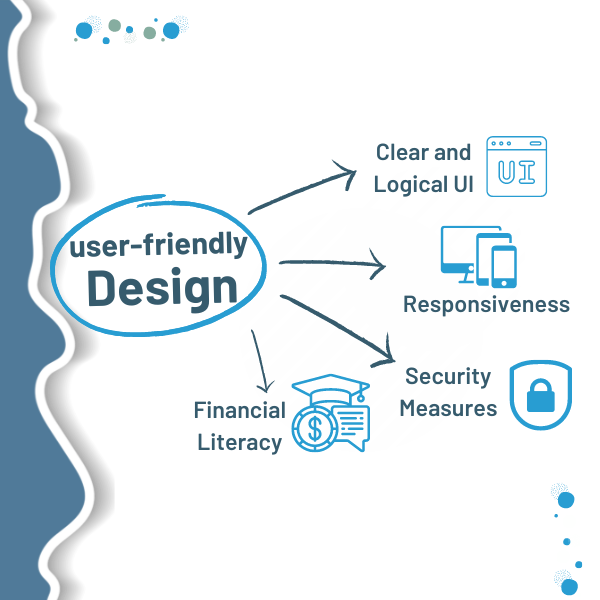

Financial App With User-friendly Design

The accessibility and usability of financial apps are directly influenced by user-friendly design, which makes them intuitive and simple to navigate for users of diverse technological expertise.

The Objectives of your user-friendly financial apps must promote the following:

Clear and Logical UI

Clear and logical user interfaces, combined with simple navigation make the app user-friendly. It lets consumers manage their accounts, perform transactions, and obtain critical information with ease. This not only saves time but also reduces the possibility of errors, minimizing user annoyance and boosting long-term app engagement.

Responsiveness

A user-friendly financial app also encourages trust and security among its users. Individuals are more likely to regard a platform as respectable and reliable when they interact with an application that is visually appealing, coherent, and responsive.

Security Measures

Security measures integrated into a well-designed app, such as biometric authentication and encryption, improve data protection and increase users' trust in conducting financial transactions through the app.

Financial Literacy

Another area where user-friendly design is important is in promoting financial literacy. Following their spending patterns, users can better understand their financial situation. They can easily follow their spending patterns, and make educated decisions by presenting complex financial information in a digestible manner.

And these are only possible through visual aids, interactive graphs, and simplified language. This not only gives people control over their finances, but it also contributes to their general financial well-being.

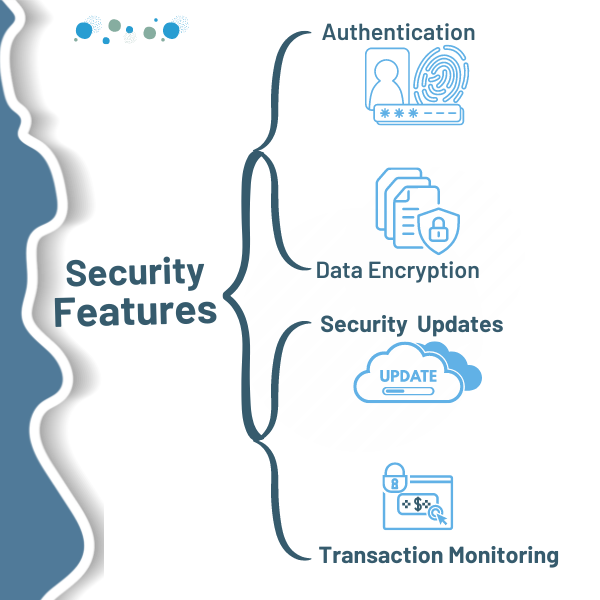

Security features for financial apps

Given the sensitive nature of the information handled by financial apps, security features are of the utmost importance. These features are critical not only for securing users' financial information but also for developing trust and confidence in the app's dependability. To maintain the security of user information, financial apps often incorporate a number of critical security measures.

The following features are as follows:

Authentication

Robust authentication is a key security element. Two-factor authentication (2FA) adds an extra layer of protection by asking users to give a second piece of proof in addition to their password, such as a code texted to their mobile device. Biometric identification, such as fingerprint or facial recognition, provides an additional degree of identity verification that is difficult to imitate.

Data Encryption

Another crucial security component is data encryption. End-to-end encryption ensures that data sent between the user's device and the app's servers is encrypted and cannot be read by bad actors. Furthermore, data saved on the app's servers should be encrypted to prevent unauthorized access in the event of a breach.

Security Updates

Security updates are required on a regular basis to address vulnerabilities and patch any potential exploits. Financial apps should be subjected to regular security audits and testing to identify and correct system flaws. These upgrades not only improve security but also highlight the app's dedication to continuing security.

Transaction Monitoring

Furthermore, real-time transaction monitoring is critical for quickly recognizing any suspicious activity. Users can be notified of any unexpected transactions or account access via automated notifications, allowing them to take fast action.

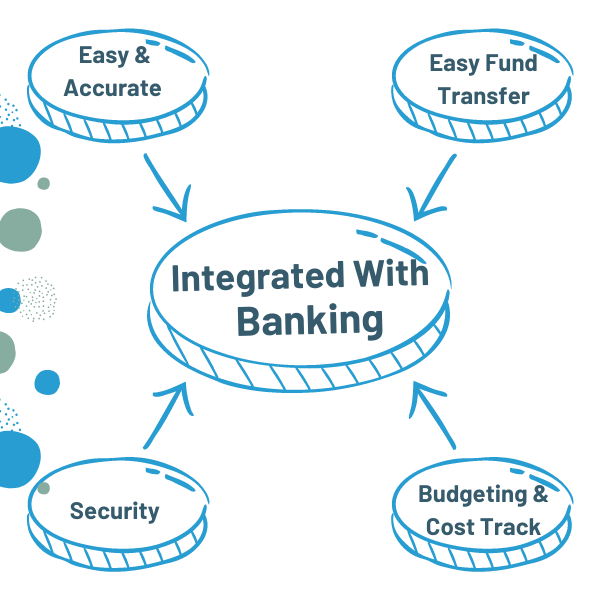

Financial App Integrated with Banking Systems

Integration with banking systems is critical in current financial technology because it bridges the gap between traditional banking services and digital innovation. This integration allows for smooth and real-time interactions between financial apps and banking infrastructure. It provides consumers with a slew of advantages that improve their convenience, efficiency, and overall financial management.

Hence, let's go through some of the important advantages or benefits of financial apps

Easy & Accurate

The ability to give customers up-to-date and correct account information is one of the primary benefits of connecting financial apps with banking systems. It can provide real-time insights into balances, transactions, and even pending payments by directly linking to a user's bank accounts.

This not only provides consumers with a complete picture of their financial situation, but it also eliminates the need for them to log in to numerous platforms separately.

Easy Fund Transfer

Furthermore, connectivity with banking systems enables easy fund transfers. Users can initiate transfers across their accounts without having to browse via several interfaces. They can access both within the same bank and across multiple financial institutions. This streamlined process increases transaction speed while decreasing the likelihood of errors.

Budgeting and Cost tracking

Budgeting and cost tracking can also be automated using integrated financial apps. These apps can provide users with significant insights into their financial habits by classifying transactions and analyzing spending patterns. This tool supports users in more successfully managing their finances and making educated decisions.

Security

It's a must-include thing in every feature of financial apps. Security is also an important consideration when integrating with banking systems. Reputable financial apps utilize encryption technologies to provide safe connections, protecting sensitive user data during data exchange between the app and the user.

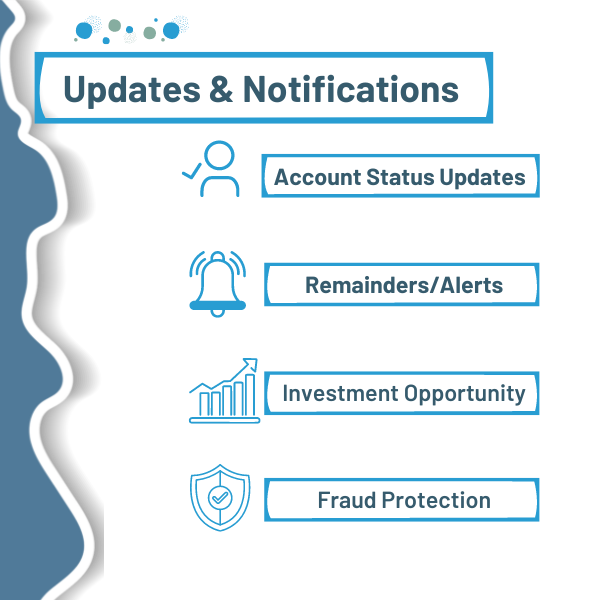

Real-time updates and notifications

Real-time updates and notifications are critical in improving user experiences within financial apps. Providing timely and relevant information enables users to make informed decisions and maintain control over their financial operations.

Let's see in what ways the update and notification feature of financial apps helps with:

updates Us with Account Status

Receiving real-time updates on transactions, balances, and account activities is a significant advantage. Users receive immediate notification of any incoming funds, outgoing payments, or changes in their account balance. This real-time feedback assists users in keeping track of their financial transactions. It helps users detect irregularities or unlawful transactions. Hence, they can respond quickly if assistance is required.

Remainder/Alerts

Notifications also act as reminders of approaching deadlines, payments, and financial obligations. Automated alerts ensure that users never miss bill payments, loan installments, or credit card due dates, allowing them to avoid potential late fees and penalties. This proactive approach to financial responsibility management promotes financial discipline and credit worthiness.

Updating Users For Investment opportunities

Furthermore, real-time updates are required for investment monitoring. Users can sign up to receive notifications on market swings, stock price movements, and investment opportunities. This enables them to take advantage of favorable market conditions or to take corrective moves to limit prospective losses.

fraud protection

Another important feature of real-time notifications is fraud protection. Any questionable activity, such as unusual login attempts or significant transactions, is instantly reported to users. Users can take an instant action to secure their accounts, change passwords, or report any unwanted access to their financial institution thanks to immediate warnings.

Don't Want To Pass Up The Chance To Enhance Your Financial App?

Let's Discuss Your Opportunity!

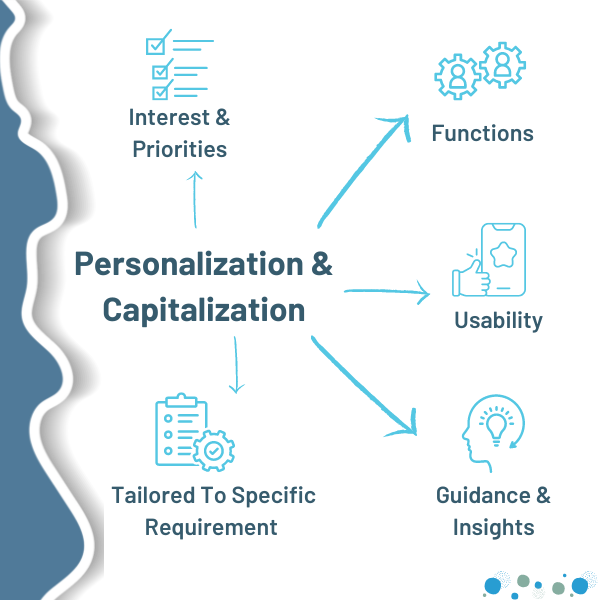

Personalization and customization options

Personalization and customization choices are essential features of current financial apps. It responds to individual users' various and distinct demands, eventually improving their financial management experiences.

Let's explore how these options improve financial management experiences of financial apps.

Interest and Priorities

Personalization features allow financial apps to adjust their interfaces to users' interests and priorities. Users may customize the app by selecting color schemes, layouts, and themes that represent their particular style.

It makes it not only visually beautiful but also a reflection of their identity. This sense of ownership strengthens the user's bond with the app, encouraging more frequent engagement.

Functions

Additionally, customization possibilities include financial functions. Users can configure alerts, reminders, and notifications depending on their individual financial objectives and obligations. These customized notifications keep users on track and responsible for their financial objectives.

That too, irrespective of whether it's a reminder to pay bills, save a certain amount each week, or track spending in specific categories.

Usability

Personalization improves usability as well. Users can rearrange menu items, prioritize functionality, and create shortcuts to commonly used functions. This simplifies navigation and guarantees that users can easily access their chosen tools, making the app more user-friendly and efficient.

Guidance and Insights

Personalization is crucial in the field of financial guidance and insights. Financial apps can evaluate users' spending habits and provide customized recommendations for financial health improvement. These insights are highly relevant and useful for users.

It advises users with methods to cut wasteful spending or discover investment opportunities that are consistent with the user's risk profile.

Tailored to Specific Requirements

Finally, personalization and customization features enable users to tailor their financial app experience to their specific requirements. This not only increases engagement but also allows users to take greater control of their finances. It supports users to make well-informed decisions that are in line with their personal goals.

Seamless user experience across devices

A unified user experience across devices is a characteristic of modern technology. It is important to the success of financial apps. In an age when users switch between smartphones, tablets, laptops, and even smartwatches, an app's ability to provide a consistent and smooth experience regardless of device is critical.

Now, we will understand how seamless UX across devices enhances financial apps.

Responsive Design

The foundation of a seamless user experience is responsive design. Financial apps must be designed to easily adjust to several screen sizes and orientations. It must also ensure that users can access the app's full functionality whether they're using a small mobile screen or a bigger desktop display.

Functional continuity

Users should be able to switch between devices without losing their progress or suffering interruptions. This necessitates real-time data and setting synchronization across devices, guaranteeing that changes made on one device are promptly mirrored on all others. The experience should be fluid and unbroken whether a user initiates a transaction on their smartphone and completes it on their laptop or vice versa.

Security

Security is an important factor when it comes to providing a consistent experience across devices. Regardless of the device used, user authentication measures must be rigorous enough to ensure that only authorized persons can access their accounts and complete transactions.

This necessitates the implementation of multi-factor authentication and other security measures that interact seamlessly with the user's environment.

Conclusion

To sum everything up, a good financial app should include robust security measures, smooth connectivity with banking systems, real-time updates and notifications, customization possibilities, and an easy-to-use design. These elements work together to provide an environment in which users can confidently manage their finances, make informed decisions, and interact with the app on a frequent basis.

Financial apps may generate trust, increase user loyalty, and prosper in the competitive digital market by addressing customers' requirements and concerns while delivering a secure and intuitive platform.

Hence, don't pass up the chance to improve user experiences, increase engagement, and stay ahead in the digital financial industry. Hire our financial app development services to accomplish all the features mentioned above in your financial apps. Our track record of providing top-tier financial app solutions distinguishes us as an industry leader. Join and collaborate with us to propel your financial services to new heights.

Contact us immediately to discuss your project, inquire about customization options, and begin the journey toward a sophisticated and secure financial software that your users will appreciate. Let's work together to change the way people manage their money, increase financial literacy, and establish long-term trust in your business. Reach out now to take the first step toward a more prosperous financial future.

June 27, 2025

June 27, 2025

Balbir Kumar Singh

Balbir Kumar Singh

0

0

June 13, 2025

June 13, 2025

Balbir Kumar Singh

Balbir Kumar Singh

0

0

Leave a Reply